Section 179 Tax Deduction for Medical Purchases

What is Section 179?

Section 179 of the IRS tax code lets businesses deduct the full purchase price of qualifying equipment and software within the tax year. For medical practices, this means you can write off new equipment the year they’re put into service.

What Types of Medical Purchases Qualify for Section 179?

Under Section 179, healthcare provides can deduct qualifying purchases such as medical equipment, off-the-shelf software and furniture.

When is the Deadline for Section 179?

To qualify for a full deduction, equipment must be purchased or financed and placed into service between January 1, 2025, and December 31, 2025.

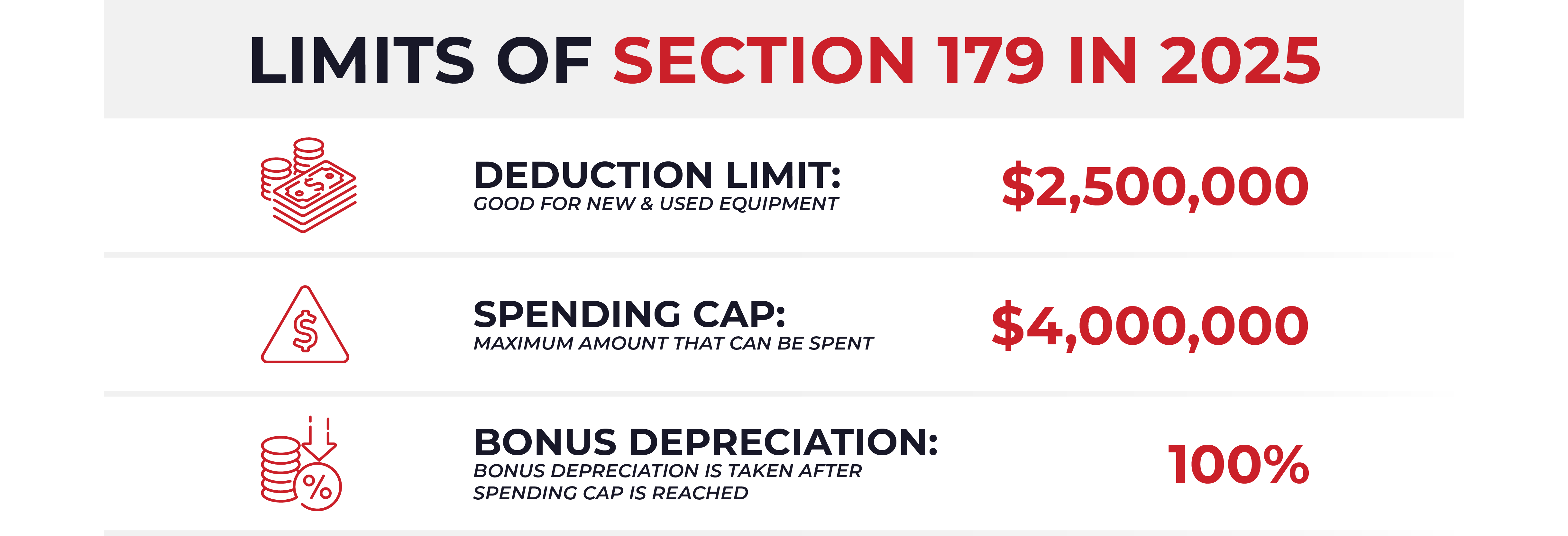

Limits of Section 179 In 2025

There are some important limits to Section 179 deductions to be aware of. For more information, click here.