Section 179 Tax Deduction for Medical Purchases (2023)

What is Section 179?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased during a given tax year.

For Doctors and other medical practices, a Section 179 tax deduction allows you to deduct the prices of medical devices and equipment the year it is purchased into service. By investing in your practice with the newest medical equipment and technology, you can provide higher quality care to your patients while freeing additional cash flow.

What Types of Medical Purchases Qualify for Section 179?

Equipment used by doctors and clinics qualify under Section 179. For example, medical diagnostic equipment and off-the-shelf software is deductible under the given conditions. Qualifying purchases for medical practices may also include furniture, air conditioning systems, heating and more.

When is the Deadline for Section 179?

Equipment must be purchased or financed and put into service between January 1, 2023 and December 31, 2023.

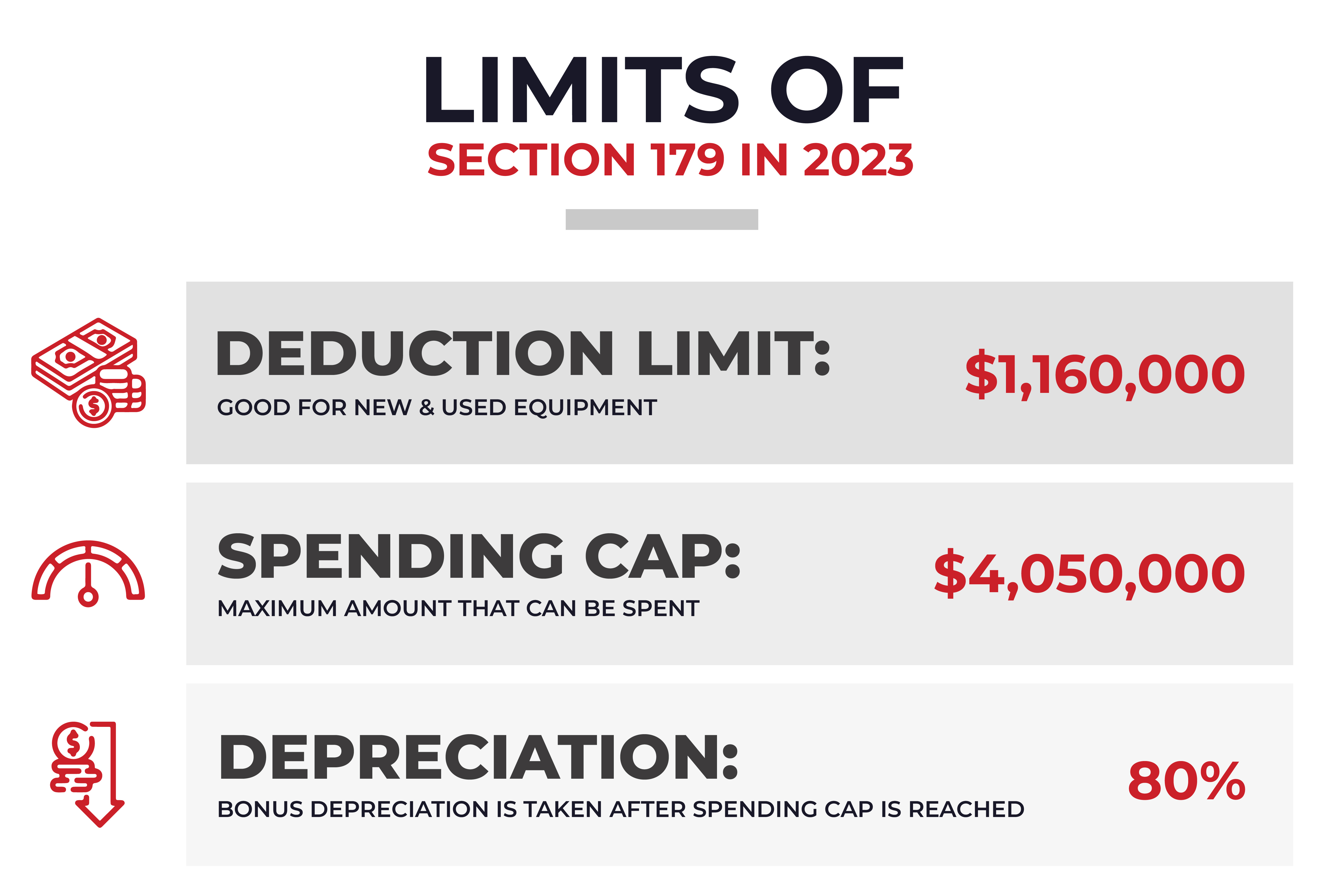

Limits of Section 179

There are some important limits to Section 179 deductions to be aware of. For more information, click here.

2023 Deduction Limit

The Deduction Limit for 2023 is $1,160,000, which applies for new and used equipment, as well as off-the-shelf software.

2023 Spending Cap on Equipment Purchases

The 2023 Spending Cap on Equipment Purchases is $4,050,000, which is the amount that can be spent on equipment before the deduction begins to be reduced.

Bonus Depreciation

The Bonus Depreciation for 2023 is 80%, which is taken after the spending cap is maxed out.